Track Expenses

Using our Purchasing tools in Sellercloud, you can calculate an average cost for your Skus and add additional expenses based on the Purchase Order.

Average cost can be calculated in two ways: Simple Average Cost and Weighted Average Cost.

Simple Average Cost – Also known as FIFO (first in, first out) is a calculation of the value of the inventory you have in the warehouse for a Sku divided by the physical quantity I have in the warehouse. Once inventory is sold, it is no longer accounted for in the Simple Average Cost calculation. This is mainly used by our resellers and drop shippers.

Weighted Average Cost – This calculation takes into account a purchasing history over a designated period. This calculation is normally used when manufacturing products to take into account the fluctuations in the price of raw materials to maintain a steady selling price.

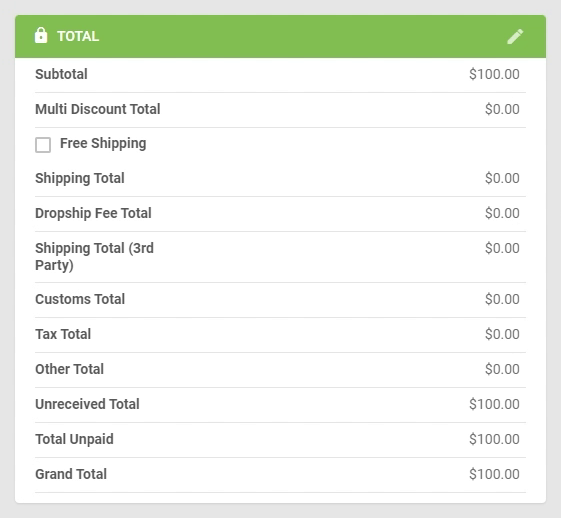

To add expenses to a PO, start by clicking the “Edit” button on the top right of the detailed page of your desired PO. You can also edit an individual menu on the detailed page by clicking the “pencil icon” in the upper right corner of the menu.

Start adding the various expenses that you would like to calculate in your average cost.

Shipping Total – shipping costs you owe to the vendor

Customs Total – customs fees for international POs

Tax Total – taxes you owe for this PO

Other Total – other expenses you would like to track and calculate in your Average Cost

From the “Actions” dropdown, you can “Recalculate Average Cost of Products” after adding or editing your expenses.